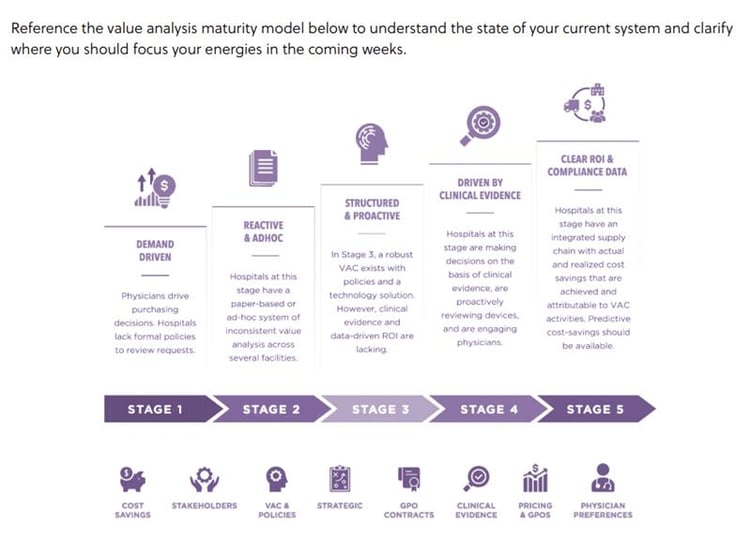

Introducing the Value Analysis Maturity Curve: A Five-Step Guide

Value analysis is a pressing subject for any hospital or health system: Medical costs are greatly surpassing the national inflation rate, and there's increased internal responsibility on hospital systems to adhere to complex regulatory structures. As a result, building a vigorous and mature value analysis infrastructure is all but a requirement to deliver cost-efficient, quality-driven, and outcomes-focused performance.

In this article, we present symplr's Value Analysis Maturity Curve, which outlines the processes that mark an increasingly developed value analysis infrastructure in health systems.

When progressing through the value analysis maturity curve, it is important to understand that stagnancy in any stage is not only possible, but commonplace. As a result, many hospitals fail to reap substantial results and remain absorbed in the early, cost-intensive processes where savings may not surpass infrastructure investment. Intentional and synchronous efforts are needed to climb to the next stage in the curve and realize meaningful results.

Stage one

In stage one, physician demand for product requests and GPO contracts are the primary drivers of procurement, and there are no formal strategies or measurement tools in place to perform value analysis. This reactive stage is marked by a lack of standardization and consistency when it comes to product and processes. When hospitals operate in this stage, daily transactions—rather than strategic efforts—command focus and energies.

Without a dedicated infrastructure to support collaboration across departments, physician engagement is limited to new-product requests and executive leadership in decision is lacking. Finally, data plays an insignificant role in stage one, as any evaluated data is most likely exclusively sourced from suppliers.

Stage two

In stage two, healthcare organizations make advancements through the creation of value analysis committees (VACs). While VACs may have little experience and training at this point, they are seen as gatekeepers to procurement. The creation of VACs also introduces procurement accountability, as it diminishes the potential for inappropriate motivations behind physician requests, including non-disclosed investments.

Efforts to increase the presence of value analysis include information gathering both internally and externally, as well as goal setting, the introduction of product reviews, analyses in cost reduction, and the elimination of waste (e.g., instances of misuse). In this stage, the primary focus and motivation is cost reduction, and paper-based efforts may still guide ad-hoc value analyses.

Stage three

Stage three marks a shift from reactive processing to proactive strategy, as VACs become a robust asset that leverages technology solutions. Using technology serves as a key steppingstone toward building a clinically integrated framework. However, clinical evidence and data-driven ROI are still lacking in this stage, as cost reduction remains in the driver’s seat and physician engagement is limited.

Stage three markers of progress often include:

- Standardization across systems to increase consistency of processes and products

- Improving effectiveness and representation of VACs through a multidisciplinary approach

- Increased education to amplify expertise within VACs

Stage four

In stage four, healthcare organizations make substantial strides toward an integrated framework by prioritizing two leaders in successful value analysis: clinical evidence and physician engagement. Bolstered by technology and feedback loops, physicians serve on committees and become champions of collaborative efforts. In value analysis, data, specifically clinical evidence, is gold; it locates the elusive sweet spot where clinical outcomes and financial demands cohabitate.

However, for evidence-based decision making to take place, data must be specific, of high quality, and diverse enough to ensure accuracy, which is the motivation behind gathering clinical evidence outside of supplier-provided streams in stage four.

Stage five

In stage five, value analysis becomes increasingly proactive as it shifts focus to predictive measures, including longer-term ROI and the entire care cycle of the patient. Decisions in this stage of the maturity cycle are never made without high-quality clinical data. Further, standardization allows the stakeholders to promote anticipatory measures to manage any potential disruptions in the supply chain or variations in patient needs.

The benefits of value analysis and an integrated supply chain far outweigh the cost of infrastructure in stage five, as efforts come to fruition in locating the nexus of quality, outcome, and costs. This is the optimal balance necessary to remain sustainable in the current climate of increasing costs and greater fiscal responsibility. In this stage, value analysis is embedded into the hospital system through C-suite ownership, a centralized and transparent knowledge database, interdisciplinary input, and robust communication.