A Healthcare Compliance Attorney Puts Hospital Price Transparency to the Test

The Hospital Price Transparency Rule has been in effect for almost a year. As an attorney, compliance software solution consultant—and healthcare consumer—I decided to try out the online tools to get a feel for the patient experience of tracking down prices for acute care.

But first, some background.

In any other buying experience for any other service or product, a consumer would expect to know the price they would pay before entering a transaction. But in healthcare, it’s a different story; neither patient nor provider (health system, hospital, and individual physician) necessarily knows the price of the procedure or service. The complexity of healthcare pricing stems from “the institutional settings in which prices are set,” according to a Health Affairs article. Prices are largely determined administratively and through negotiations, with players ranging from the Centers for Medicare and Medicaid Services (CMS) to states, private payers, employers, and patients—who themselves are shouldering an increasing percentage of cost out of pocket.

More research is needed to gauge patient and provider cost awareness, but a study found that in a sample of 1,664 people surveyed who spent out-of-pocket amounts for their last healthcare encounter, only 52% were aware of the price before they received care. Just 13% had done research on what their out-of-pocket cost would be. Some 10% reported they had considered going to another provider, while only 3% had compared prices across providers.

What are hospital price transparency regulations?

For hospitals and health systems, the Hospital Price Transparency Rule was effective January 1, 2021, and requires them to post their standard charges in two ways:

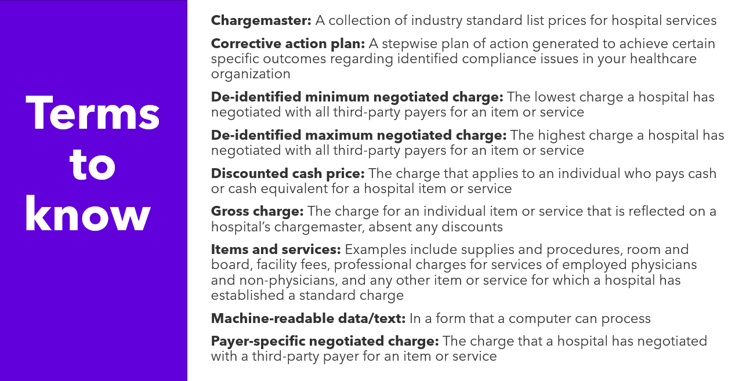

- First, hospitals must post a machine-readable file containing standard charges for all items and services it provides. They must post gross charges, discounted cash prices, payer-specific negotiated charges, and de-identified minimum and maximum negotiated charges.

- Second, hospitals must display information, in a consumer-friendly format, on at least 300 “shoppable” services that a healthcare consumer can schedule in advance. There must be a description of the service and any other services that the hospital customarily provides in conjunction with the main service. Other information must include the discounted cash price, payer-specific negotiated charges, and de-identified minimum and maximum negotiated charges.

For payers, the Transparency in Coverage Rule’s first phase went into effect in July 2022, and other phases are planned for 2023 and 2024. On July 1, health plans and issuers of group or individual health insurance were required to begin disclosing pricing information in two machine-readable files: 1) An in-network rate file containing rates for all covered items and services between the plan or issuer and in-network providers; and 2) An allowed amount file containing allowed amounts for, and billed charges from, out-of-network providers.

symplr Compliance offers a Risk Assessment Management module that helps our customers perform risk assessments on hospital and health plan price transparency. See a demo today.

Who enforces healthcare price transparency rules, and what are the costs of violation?

The CMS enforces healthcare transparency requirements. If violations are brought to light, CMS can take the following actions:

- Issue a warning notice

- Request a corrective action plan

- Impose a civil monetary penalty

CMS posts organizations’ names and the monetary penalty amounts on its site, adding another layer of “pain” for health systems that are in violation. Further, CMS is just starting to enforce the transparency requirements with civil monetary penalties. If a civil monetary penalty under the False Claims Act is issued, it is calculated on $10 per bed per day basis, with a minimum penalty of $300/day and maximum penalty of $5,500 per day of non-compliance. Yearly non-compliance penalties can range from $109,500 to more than $2,000,000. It has yet to be seen whether these audits and penalties will act as deterrents to violations.

My experience navigating hospital price transparency tools

Putting the Hospital Price Transparency Rule to the test (providers)

- I started by navigating to my local hospital’s website, where I didn’t find any reference on the main page for price transparency information. When I searched on “price transparency,” I was taken to a price transparency page that had links for price estimates for hospital services and price estimates for doctor’s office services. On other hospital websites, I had varying degrees of difficulty finding price transparency information. None of the websites I visited had a link on the home page, with most taking at least four clicks to get price transparency information.

- I was then taken to a legal disclaimer that I had to accept to progress in my search.

- Having accepted the disclaimer, I could then search for categories by using keywords or CPT codes, either by specifying whether I was or was not insured. If I chose insurance, I had to enter my insurance details including my demographic information.

- Several hospital websites I chose could not verify my insurance information, so I had to try using the uninsured option.

- Most procedures listed did have cost estimates and made more information available for most of the fields of information. The cost estimate for “not insured” included a hospital discount.

- One hospital website was able to verify my insurance information and I could see the price I would pay for certain specified services with my deductible and coinsurance amounts listed. There were no minimum and maximum negotiated charges listed.

Putting the Transparency in Coverage Rule to the test (payers)

- First, I had to sign into my insurance portal to see any pricing. From my limited efforts, it appears that at least a few insurance plans would not allow someone to view a price who was not a member.

- Once I got in, I had to search by individual provider, but I could get there by finding a provider by type or reason for visit. When I found my provider, only one category of procedure with one type of problem visit was listed—and that was “office visit.” Of the 17 office visits listed under type, only three costs were shown. The other procedures listed either showed $0 or stated, “Cost not available; talk with us or call the number on the back of your XXXXX ID card.”

- When I clicked for further details, I could see a total cost breakdown, which figured in my specific deductible.

- I had a similar experience searching on other providers, with many listing procedures without a cost amount.

- When I searched on my local hospital, a thorough list of outpatient procedures appeared, but all of them said, “Cost not available; talk with us or call the number on the back of your XXXXX ID card.” There were no prices listed for any outpatient procedure or office visit. There were a handful of inpatient procedures listed with prices. But many procedures, such as “Cost for Pregnancy – Vaginal Delivery” were not shown, instead stating, “Cost not shown at provider’s request; talk with us or contact your provider to discuss costs.” Another error message on the cost for various procedures I checked (e.g., Gallbladder Removal, Laparoscopic) was, “Not enough procedures performed at this location to calculate costs; talk with us or contact your provider to discuss costs.”

- For Pneumonia, under Inpatient Services, I found a $7,000 range listed as total cost before applying coverage, and my cost was broken down into deductible and copay to arrive at one estimated out-of-pocket cost.

- For Laboratory, there was an extensive listing of laboratory tests. However, only 50% of those tests had associated cost estimates listed.

- For every estimated cost I could find, there was an associated disclaimer that said, among other things, that the estimated cost may not be the final cost and should not be relied on to make final decisions about healthcare, and that actual costs could vary.

The verdict: Hospital pricing is not yet consumer friendly

Likely because healthcare consumers are paying higher out-of-pocket costs for care, they’re slowly becoming more aware and more demanding about healthcare price transparency. Healthcare payers and providers are finally catching up, but there is a long way to go. Thanks to the price and coverage transparency rules, the pressure is on providers and insurers to disclose prices. The movement toward value-based payment models will also increase this pressure for price transparency, because providers will start taking on financial risk for the care they provide to patients.

In my limited experience trying out various online price transparency tools, there are some indications that the tide is turning. I feel hospitals could do a better job in directing patients to the price transparency section of their website, as I found the navigation experience was lacking. But several hospital prices were discoverable, and this is a step in the right direction. Health insurers seem to be doing a better job with transparency, in my experience, although many categories of care did not have any price or coverage information.

My verdict: There is room for improvement with price transparency and I look forward to trying these tools out again in a few months to see what changes will be made. Stay tuned!

symplr Compliance offers content in our Risk Assessment Management module that helps our customers perform risk assessments on hospital and health plan price transparency.